Her mom Jane Gordon was a gossip columnist for the Sunday Mirror.** Gossip columnist, of course, is one of the stranger realities of journalism. It’s a symbiotic relationship where for the most part, the people one is revealing tawdry tales about need exposure to assist in their celebrity. You might be surprised, it often takes very keen reporting skills, as one is usually walking the fine line of legal actions. Sometimes people get hurt. I have no idea if Bryony Gordon‘s mother was good, bad, professional or anything about what type of integrity she brought to her job, but good gossip columnists are actually highly skilled reporters, contrary to what most of the public perceives.

I can tell you, the younger Gordon seems to lack the same skill set as her mother’s segment of the profession.

I have a Google alert for news related to “Super Rich.” It provides an interesting mix of tidbits. Today, the top item read “Bryony Gordon: The only attractive quality of the super-rich is their money.” She is a columnist for The Telegraph, and it appears that her gig means churning out something at least once a week if not more, not always an easy task. I give her credit for using her column to talk about her own depression and bring mental health issues to the forefront. It’s very brave, and she deserves congratulations.

Jealousy, however, is a dangerous thing, and today’s column was all about ignoring the facts and perpetuating incorrect stereotypes. Maybe she didn’t have time to do the research.

Her targets may or may not have been worthy, including a Kazak oil baron, Sting who rails about the environment, but then took money from the billionaire to play at his son’s wedding, a hedge funder who apparently likes cocaine and orgies as well as a 46-year old UHNW entrepreneur who is divorcing his wife of 14 years and dating a 27-year old “Polish lingerie model”. I’m not sure the relevancy of where his girlfriend is from. Would it have been different in Ms. Gordon’s view if the lady was from Bournemouth?

Gordon paints with a very broad brush, writing, “The super-rich are not like the rest of us. No. They’re far, far worse. Entitled and very often in possession of more money than sense (or taste), they live by different rules, on different planets, with different moral compasses.”

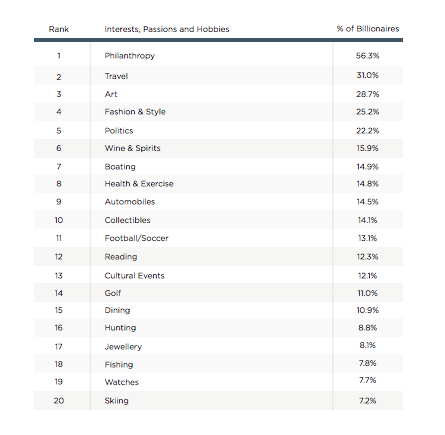

In her assessment, “For every Bill Gates, there are another 10 billionaires whose idea of charity is showing off their disgusting car collection to the povvos of Knightsbridge.”

Dear Bryony, let me give you a few facts.

Mostly, the term Super Rich refers to folks with a net worth of $30 million or more. Wealth-X, which does a pretty good job researching the market, estimates there are about 210,000 households globally that qualify.

There is quite a bit of research about where their money comes from. Yes, some had connections to get a foothold into their profession as you did from your mother. I had entry from my father, for which I am grateful.

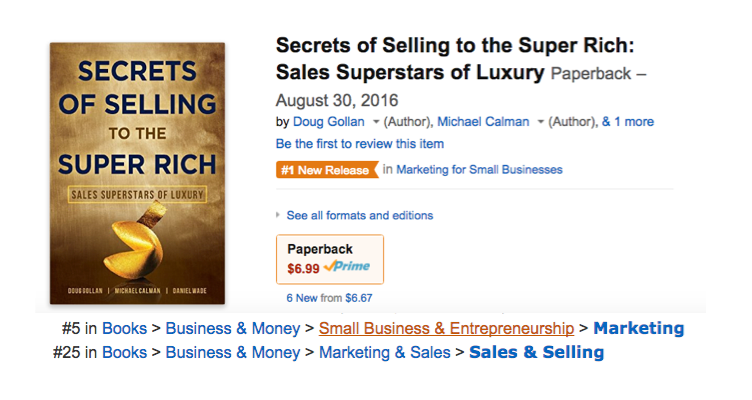

But as they say, once you get in the door, it’s your show, and clearly you’ve done very well. But just to enlighten you, most surveys show about three-quarters or more of the Super Rich are self-made. From a book I co-authored in 2007 where we interviewed over 600 private jet owners, close to 90 percent were self-made. Then again, the reason most had their private jets was a business tool, not to showoff to Architectural Digest. Yes, there are celebrities and oil barons, but I think you might be surprised that your narrow view of rock stars and Knightsbridge doesn’t represent the global population.

In fact, in terms of where they come from, you might be surprised that there are more Super Rich families from the American flyover state of Minnesota than Saudi Arabia, and the same for Wisconsin vs. Russia.

How did they make their money?

Think mundane things like manufacturing all sorts of parts and devices, distribution of everything from oranges to medical devices, farming, auto dealerships, operating franchises of all types, making packaging, real estate development, and not just office towers, but communities for all types of folks. There are lawyers, fund managers and global bankers for sure. There are also local bankers, whose community banks operate throughout the South, West and Midwest in the US and are still a place small businesses can get a loan to start or expand.

And by the way, what did Sting do with the money he received from playing the wedding?

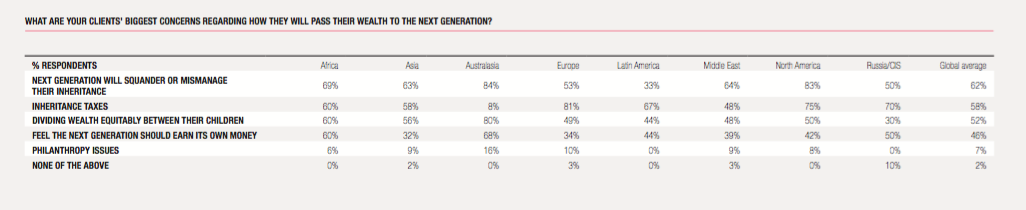

I don’t know, but Wealth-X notes UHNWs donated $112 billion in 2014. As an aside, American billionaires, according to the research, donate an average of $179 million in their lifetimes.

Yes, your column could have meant to be tongue in cheek. You conclude, “We often sit and dream about what we would do if we were ever to win the lottery: buy mansions, travel on private jets, run around in Lamborghinis. What we never factor in is: “turn into a complete rotter”. Perhaps I’m just envious. But join the ranks of the super rich? You couldn’t pay me.”

Of course, what your rant ignored is that for the vast majority of the Super Rich, they didn’t lollygag around daydreaming. They spent a good part of their adult lives making if happen. I say kudos to them. Lot’s of very inspirational stories about folks who came from nothing and made a lot, in some cases creating things that improved our lives.

And, yes I do understand that it’s a challenge to turn out quality columns and still drive the Internet clicks your bosses judge you on. Of course, finding the UHNWs I described and you are not aware of can be difficult. Like most of us, they are living below the radar, more than happy to spend time building their business and enjoying life with their friends and family privately, not showing off.

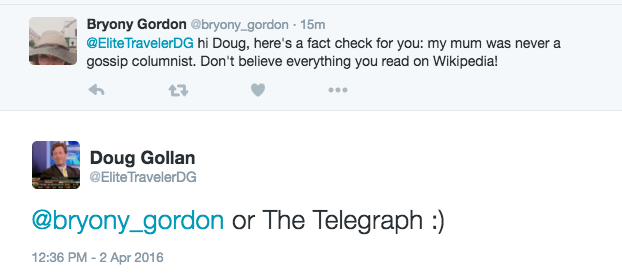

**Note: The younger Gordon took the time to Tweet me the following: